This project was focused on bringing sales tax to our mobile platform. With it’s specific rules and regulations based on multiple variables in one transactions, sales tax is a complicated and stressful concern for business owners.

January - April 2020

Product designer and researcher

Figma, Invision

I am a small business owner that wants to invoice on the go and be tax compliant, but I'm not sure how to set up sales tax and customize it when necessary. This makes me feel frustrated and like QuickBooks is the wrong invoicing tool for my business.

Create small businesses that are confident in their transactions and flex to their unique needs.

Our process started with interviewing web users to understand the pain points, awareness, and concerns of sales tax.

From these interviews we learned users are cautious applying tax, there is a lack of transparency around rates in the current experience, and there are varying levels of complexity in sales tax needs.

Users who don't know what rate they need and want quickbooks to provide them a automated rate.

Users understand that their transaction needs a sales tax rate, but they often reference a government site to double check the rate because they don't trust the calculation.

Users who know exactly what they need to charge for sales tax, and know about exceptions and specific sales tax rules that apply to them.

Over two studies we tested both the set up flow and the sales tax management measure understanding and efficiency. We learned:

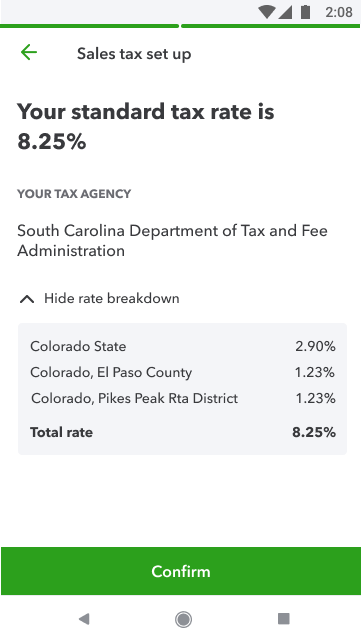

• The language of setting up an agency didn’t resonate with our users, instead they really focus on language around rates

• They’re constantly looking for confirmation and looking to understand more about their rate

• When the rate doesn't match they're looking for the fastest way to amend it.

Set up

Management

Set up

• Our V1 launch had some limitations around how much rate information we could generate. However we still aimed make set up a short confirmation by auto filling your business address on file.

• For transparency we explain where the generated rate comes from to build our user's confidence in our calculation.

• Once they finish we provide tips and guidance of what they can do now with tax set up.

Rate management

• We wanted to keep the rate front and center throughout this process, and made the numbers large and prominent.

• To scale for custom rates and calculation breakdowns, that did not make it in our V1 launch we created a sales tax page that offers space for future iterations.

After launch

WHO START SET UP FINISH (task completion)

Companies have set up sales tax on their app